Buying a home is a big deal - so while it may be tempting to go with the first word-of-mouth recommendation you get, when it comes to choosing a real estate agent, it pays to do a bit more research. A real estate pro will be responsible for determining a good purchase price, coordinating conversations with sellers and seller agents, and ultimately, walking you through the entire buying process. To make an informed choice take the time to interview several of the best candidates before making a decision. Here are 14 questions to ask potential real estate agents.

What to ask when interviewing a real estate agent

Jun 22, 2019 8:13:00 AM / by Brett O'Daniell posted in real estate agent, realtor, homebuyers, homes for sale, selling agent, home ownership

Visiting an open house this weekend? What should you say to the agent?

Jun 21, 2019 1:46:00 PM / by Mark Gorman posted in real estate, buyer's agent, homebuyers, dual agency, agency, listing agent, selling agent, home showings, procuring cause, home tours, open house, home for sale

When you visit a public open house and an agent asks you to sign the "sign-in sheet" what should you say? What should you write down? What are the rules for who can represent you if you decide that the Open House is, in fact, your future Dream House?

Many times the agent holding the open house states the seller is requiring a list of everyone who walked through the house as a measurement of interest and to get feedback on the price and condition of the property. Some agents state that their company policy, brokerage and/or seller require the list of visitors for security reasons in case something ends up missing from the house.

While these are legitimate reasons, if you have ever provided your real contact information at an open house, you have probably experienced being contacted for something other than the explained reason. Most likely you were solicited to see if you wanted an agent to show you a different house or if you needed pre-approved for a mortgage.

Confused by all the letters? Here are some basic mortgage acronyms.

Jun 20, 2019 7:09:00 PM / by Mark Gorman posted in Mortgage, PITIA

Components of a Mortgage Payment: PITIA

- P stands for Principal or the amount you borrowed.

- I stands for Interest. Lenders charge interest for the money you are borrowing. The interest generally reflects prevailing market rates based on investor demands.

- T is for property taxes.

- I represents Homeowners Insurance premiums (hazard insurance), which is mandatory.

- A stands for Association, as in homeowners association. For some residential properties, HOA dues are required.

Fixed Rate vs. Adjustable Rate

- With a fixed-rate loan, the interest rate charged by the lender never changes over the life of the loan. That means the P (principal) and I (interest rate) portion of your PITIA payment will not change. However the T (taxes) and I (insurance) portions may change if your taxes or insurance premium change. Many people prefer the stability of a fixed-rate loan.

- With an adjustable-rate loan, the interest rate can increase or decrease. There are a large variety of adjustable-rate mortgages (ARMs).

Government Loans vs. Conventional Loans

- Government loans include VA loans guaranteed by the Veterans Administration, FHA (Federal Housing Administration) loans administered by the U.S. Department of Housing and Urban Development (HUD) and USDA Rural Loans insured by the U.S. Department of Agriculture.

- If a loan is not insured or guaranteed by a government agency, it is considered to be a conventional loan. These loans are often purchased by Fannie Mae and Freddie Mac, although this purchase is typically invisible to the member. If you have less than a 20 percent down payment, you will likely need private MI. The advantage of MI is that you need less upfront cash and can buy your home sooner.

Length/Term of the Mortgage

There’s little margin for error! See the latest homebuyer tips.

Jun 19, 2019 8:02:00 PM / by Brett O'Daniell posted in homebuyers, homeownership, moving

Buying your first home is a once-in-a-lifetime experience—it’s thrilling, challenging and immensely rewarding. However, in a crowded and competitive housing market, it might feel like there’s little margin for error, especially if you’re buying a home for the first time. But never fear! We’re here to help, by offering our top tips on how to be a successful homebuyer.

Discover these powerful real estate alert tips

Jun 17, 2019 8:03:00 PM / by Jeffrey Che posted in housing market, millennials, first-time, homeownership, homes for sale, Zillow, home showings, housing inventory, home tours, open house, contingent, hometraq, sold, MLS, notifications, alerts

Never miss the perfect home again!

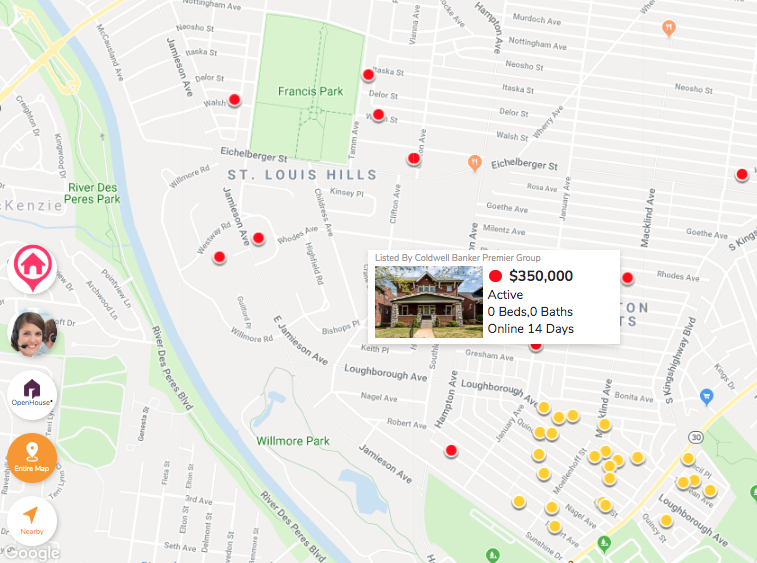

Here are a few quick ALERT tips that can make your home search much more intuitive. All you have to do is login to HomeScout and the red arrows highlighted in the images below will help you unlock these powerful features. Make sure to refine and save your Search Criteria and then turn on New Listing and Open House Email Alerts so you don't miss out when properties become available.

5 misconceptions about buying a home

Jun 16, 2019 8:40:00 PM / by Brett O'Daniell posted in homebuyers, home ownership, homebuying, misconceptions

5 tips to nab your dream home during peak buying season

Jun 15, 2019 7:19:00 AM / by Mark Gorman posted in Mortgage, real estate, before you buy

Summer is peak home buying season and that means the competition can be fierce. Use these five tips to stay ahead of the game and land the home of your dreams.

What does Pending, Under Contract, and Contingent mean?

Jun 14, 2019 7:21:00 AM / by Mark Gorman posted in listing, home showings, option, pending, home tours, cancelled, contingent, expired, kick out, short sale, status, temporarily off market, active, sale pending, sold, withdrawn

Can you schedule a showing for a home in Pending status? Does the Under Contract status mean that there is a chance the current offer on a home may fall through? Will the seller consider a back up offer from you in the case that the current buyer is unable to sell their current home soon? These are all fantastic questions and each property status requires these questions to be addressed in different possible ways.

The summer housing market is heating up

Jun 13, 2019 11:25:16 AM / by Jeffrey Che posted in home purchase, homebuyers, housing market, summer

What to expect and how to prepare

When you start thinking about buying a house, it’s easy to let your emotions run the show. Before you know it, you’re stalking homes for sale on a home searching tool like HomeScout, Zillow, or Realtor.com. You begin rearranging your schedule so you can do drive-by viewings, and researching creative financing options that would allow you to buy a house with next to nothing down.