Because they are government-backed, Federal Housing Administration (FHA) home loans have attractive interest rates and less stringent qualifications. Loan applicants must meet credit-score and down-payment requirements, and show proof of employment and a steady income. An appraisal of the home by an FHA-approved appraiser is also required. Following are six features of FHA loans first-time homebuyers should consider while weighing their financing options.

1. Flexible guidelines give more purchasing power

- Low Down Payment - as little as 3.5% down

- 100% gift allowable for down payment

- Lower credit requirements. 580 minimum FICO credit score.

- Competitive market rates

- No income restrictions

- Limited tradelines needed

- Higher debt-to-income ratios approval

- Shorter waiting period for major credit events like bankruptcy

2. FHA loans are transferable to potential buyers

This means that a home buyer who finances a purchase with an FHA-insured loan and who sells the house later, when interest rates are higher, will be able to offer a potential buyer the right to assume his or her low-rate FHA loan. In the current raising interest rate environment this is a huge advantage to FHA loans versus conventional loans.

3. Borrow cash for home repairs with FHA 203(k)

- Full and Streamline programs

- Repairs and improvements vary based on program

- Low down payment

- 640 credit score

- Owner occupied only

- All rehab work must be completed by licensed and insure contractors

- FHA/HUD consultant oversees project to protect borrower

4. Qualifying FHA Property Types

- 1-4 unit properties

- FHA approved condominiums (two types): 1. HUD Review Approval Process (HRAP) . 2. Direct Endorsement Approval Process (DELRAP): Some lenders offer the DELRAP method, which is an "in-house" underwriting department that can review and approve FHA condo projects which means faster turn times. Click here to VIEW FHA APPROVED CONDO PROJECTS.

- Planned Unit Development (PUDs): These are a community of homes that could look like single family residences, townhomes or condos, and can include both residential and commercial units, but they’re most similar to condos.

- Modular homes

- New construction

5. FHA Back to Work Program

- Available to borrowers who suffered financial hardship due to reduced income or job loss

- Shortens the waiting period to obtain FHA financing to as little as one year after bankruptcy, foreclosure, deed in lieu of foreclosure or short sale.

- Must meet FHA loan requirements

- Mortgage or credit problems that resulted from a financial hardship must be documented

- Client must have re-established a responsible credit history for a period of 12 months prior to application

- Client must complete HUD-approved housing counseling 30 days prior to loan application

6. Two types of mortgage insurance premiums to pay

- Upfront premium: 0.75% of the loan amount, paid when the borrower gets the loan which can be rolled into the financed loan amount.

- Annual premium: 0.45% to 1.05%, depending on the loan term (15 years vs. 30 years), the loan amount, and the initial loan-to-value ratio, or LTV. This premium amount is divided by 12 and paid monthly.

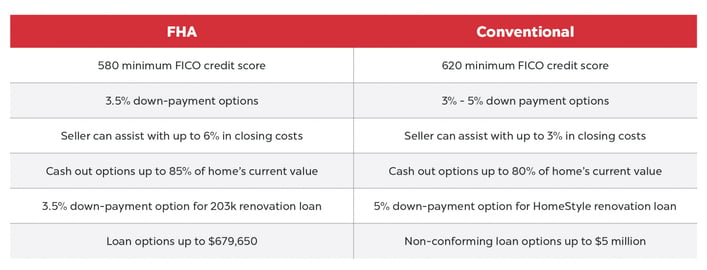

FHA and Conventional Loan Feature Comparison