Mortgage Brokers/Bankers

- Mortgage brokers are licensed originators representing multiple lenders who work as intermediaries to secure a mortgage for a borrower.

- Mortgage bankers originate and fund the loan with the funds of the lender they work for, but immediately sells the loan to another lender, an investor, or directly to Fannie Mae or Freddie Mac.

- Consider and compare potential fees that will be charged up front and at closing.

Comparing Products:

Rates

- Lock-in option preferable. Generally, the longer the loan period, the higher your interest rate.

Term

- The longer the term, the lower the monthly payment. However the equity buildup is slower as well.

ARMs

- Carefully consider your ability to absorb higher payments if the rate increases.

Points

- Discount points represent the upfront payments of interest to the lender. The lower the interest rate, the higher the discount points and vice versa. Each point is 1 percent of the loan amount.

- Origination points are charged to offset the administrative cost of processing and originating your loan. They can also include a document preparation or underwriting fee.

Down Payment

- What is the minimum down payment required?

Mortgage Insurance

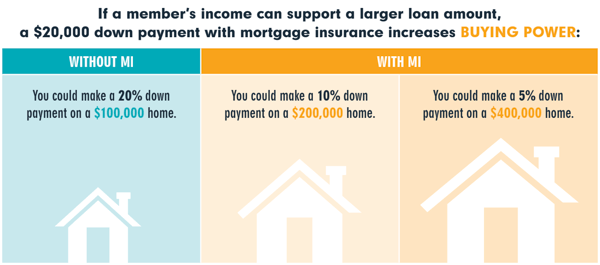

Mortgage Insurance, also called MI, private MI or PMI, is generally required on mortgages with down payments less than 20 percent of the property value. MI reduces the amount a credit union loses in the event that members do not repay their mortgage.

- Without the protection of MI, credit unions normally require a member to make a down payment of at least 20 percent of a home’s purchase price, which can mean years of saving for some members.

- This large down payment assures the credit union that the member is committed to the investment and will try to meet the obligation of monthly mortgage payments to protect the investment.

- A low down payment also allows members to purchase more home than they might otherwise be able to afford.

FHA vs. Conventional

FHA loans are guaranteed by the Federal Housing Administration and extend credit to homeowners, particularly those who have limited down payment funds and lower credit scores.

Conventional loans are typically guaranteed or insured (when required) by private mortgage insurers. Conventional loans are purchased by Fannie Mae or Freddie Mac.

Conventional Loans

- Generally require a 5 percent down payment,

with certain programs allowing as little as 3

percent down. - If MI is required, private Ml companies offer

cancelable and flexible monthly or single

premium options. - Private Ml on a conventional loan is typically less

expensive than the Ml on a FHA loan. - Typically, a minimum credit score of 620 is

required. - Often have quicker processing time than FHA

loans. - Generally have a lower loan-to-value (LTV) ratio

than FHA loans.

FHA Loans

- Require a 3.5 percent down payment, and most

borrowers have an FHA insurance premium

payment for the life of the loan. Additionally, FHA

loans have both an upfront payment (which may

be financed into the loan amount) and monthly

premium payments. - Lower maximum loan limits may be imposed

(compared to conventional). - May allow lower minimum required credit score.

What we do?

HomeTraq provides you with the superior home-hunting experience. Create a free account and tour any home within 3-5 minutes. A realtor will meet you there. No commitment. No payment. No obligation.