Whether you are a millennial just starting to think of possibly applying for a loan, or if you are a baby boomer getting ready to refinance your 3rd house, its always good to keep track of what is going on with your credit and your credit score. Here are some quick highlights as to why it is so important and how you can monitor one of your most important assets.

Credit Report Purpose

Provides history of your credit use to prospective lendersAllows lenders to assess risk of extending credit to you

Used for all forms of credit, including apartment rental, credit cards, student loans, car & home loans, etc.

Establishing Credit

Apply for credit card with a reasonable limitBuy something for approx. $100, and pay back in 2 months

Do it again, and make sure to pay on time!

4 trade lines will be needed to obtain a mortgage

12 months of activity are needed to develop credit history

What information is Included in a Credit Report?

Personal Info: name, address, date of birth, employerCredit Account History: credit card company/lender, type of account, credit limit, balance, payment history

Public Records: bankruptcy, tax liens, and judgements

Credit Inquiries: creditor and date of inquiry

What is a Credit Score?

Summary of credit report info represented as a single number, based on a mathematical calculation

FICO (Fair, Isaac, & Co.) most common score typeFICO scores range from 300 - 850; the higher the better

Predict future payment history for creditors

Scores are "fluid" - recalculated each inquiry

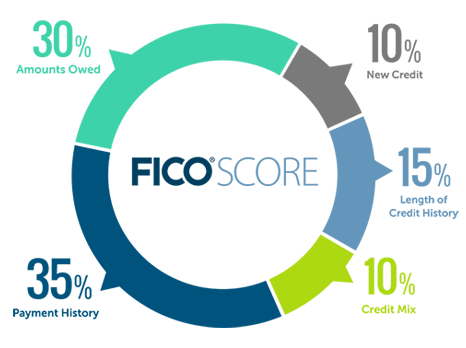

Credit Score Factors

Payment History: 35%Amount Owned: 30%

Length of Credit History: 15%

New Credit: 10%

Type of Credit Used: 10%

Getting Credit Reports

There are 3 credit bureaus and each has a credit score for you (scores may be different)

- Equifax 800-685-1111 or equifax.com

- Experian 888-397-3742 or experian.com

- TransUnion 800-888-4213 or transunion.com